The Research Tax Credit, a French tax system

In France, the Research Tax Credit (CIR) is a tax system that applies to three types of expenditure, namely research expenditure, innovation expenditure and collection expenditure. Innovation expenditure concerns only EU SMEs and collection expenditure covers clothing, leather and textiles.

To qualify for this scheme, the company must be an industrial, commercial, or agricultural enterprise and be subject to industrial and commercial profits or corporation tax. It should be noted that associations under the 1901 law with a lucrative activity subject to commercial taxes can also benefit from this scheme.

In terms of procedure, the company must calculate the expenses eligible for this scheme and compile a supporting file to be kept internally for possible tax audits.

Scientific assessments may be carried out on companies to check that the expenses declared under this scheme are eligible. For this purpose, the Ministry of Higher Education, Research and Innovation (MESRI) is in charge of tax audits, CIR approval requests and CIR rescripts.

The Research Tax Credit - CIR

Let us now take a closer look at the Research Tax Credit which applies to companies with R&D activities. The first notion to integrate is that R&D is a subset of innovation activities. Therefore, the activity in question must be carefully analysed to define its R&D nature. Thus, we can speak of R&D activity when the company carries out a scientific approach with the aim of removing scientific barriers to solve problems for which solutions do not exist in the current state of knowledge.

At the international level, R&D activities are classified into three categories:

- Fundamental research activities provide new knowledge about the foundations of observable phenomena and facts without wanting to apply or use them in a concrete way;

- Applied research activities to determine the possible uses of the results of fundamental research or to set up new methods and procedures to arrive at precise and predetermined results;

- Experimental development activities are based on the knowledge gained from research and practical experience to develop new products or processes or to improve existing processes and products.

In addition, the OECD (Organisation for Economic Co-operation and Development) has published an international methodological reference called the Frascati Manual. This book sets out guidelines for the collection and reporting of data on research and experimental development. It is so called because the OECD met in 1963 in the Italian town of Frascati to discuss research and experimental development statistics. Although basic and applied research activities are clearly defined as R&D by their nature, experimental development activities are more complicated to delimit. Indeed, they can be confused with product development activities to bring a new product to market. In this context, the Frascati Manual defines these five criteria to identify an R&D activity:

- Novelty : finding discrepancies with the result that is supposed to be reproduced or acquiring new knowledge;

- Creativity : achieving an original result or applying new concepts and ideas;

- Uncertainty : the identifiable knowledge should not allow the difficulty to be solved in advance and the probability of achieving this through experimental development should not be known in advance;

- Systematicity : planning the course of the R&D activity and recording the results;

- Transferability and/or replicability : allowing other researchers to replicate the results, including negative results.

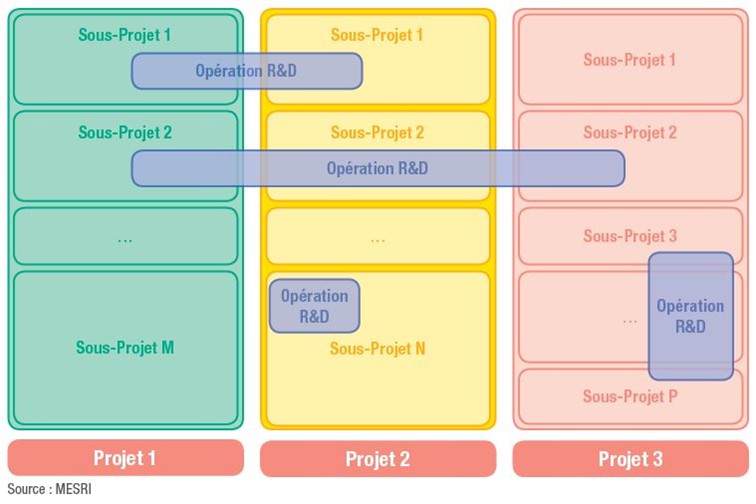

In recent years, the MESRI guide now uses the term R&D operation instead of R&D activity. As a result, it explains that an R&D operation can be identified in common with several projects of the company.

Technical justification

The methodology of an R&D activity is carried out through a study of the state of the art, then a definition of the hypotheses, an identification of the verifiable consequences and a development of the necessary theories and models. This is followed by a description of the experimental protocol and the experiments carried out, and finally an analysis of the results and a conclusion. Of course, to be useful and to increase the body of knowledge available, the results of this R&D activity must be systematic and transferable. Hence the importance of recording the course of the experiment and describing the approach followed in a precise manner so that the R&D activity is reproducible.

Each R&D operation must be described in a structured way to have a scientific approach. Therefore, the research problem to be solved must first be identified. Then, the bibliographical research is used to establish the state of the art to analyse the state of knowledge available concerning the research problem. If, during this stage, the company finds existing theoretical and practical approaches that allow the research problem to be solved, then it is not an R&D activity eligible for the Research Tax Credit scheme because there is no scientific lock.

If not, the description of the scientific approach must be continued and the hypotheses for a solution to the scientific problem and the approach to be followed must be formulated. Then comes the part that concerns the work carried out and the analysis of the results obtained to draw conclusions and formulate an answer to the problem.

Added to this, the R&D indicators must be mentioned in the supporting file. These are, for example

– Supervision of theses, including CIFRE contracts;

– Scientific collaborations with French or international public bodies;

– Publications in scientific journals or conferences;

– Patent or software registrations as well as Soleau envelopes (to date ideas);

– Subsidised projects.

A particular point concerns the case of R&D work in the field of IT. Indeed, the development of new software is not sufficient to be eligible for the CIR. Thus, R&D work in IT must satisfy one of the following conditions to be eligible:

– The creation of a technique that is proven to be original and/or better than the existing one;

– The definition of a proven methodology that is original and/or better than the existing one;

– The improvement of know-how around an existing but recent concept or technology for which the use and application to real problems is a concern or not yet established.

It is advisable to describe the reasoning followed, specifying the hypotheses, the development stages and the evaluation methods for validating or not the milestones.

Financial valuation

The company must declare the amount of the Research Tax Credit on form n°2069 when filing its annual tax return. In addition to the supporting file describing the eligible R&D work, the company must have prepared a file detailing the calculation of this amount of CIR in Excel format.

The first type of expenditure eligible for the CIR is depreciation. This concerns depreciation allowances relating to buildings dedicated to research operations as well as furniture created or acquired, and new goods acquired under financial lease and patents acquired in the context of research and experimental development operations. This is done on a pro rata basis to obtain a relevant rate.

The second type of expenditure is R&D staff expenditures such as researchers and research technicians. Their salaries, including holiday pay, benefits in kind, bonuses and additional remuneration and fair prices must be considered. But also, the compulsory employer’s social contributions, legal or conventional. This means the basic social contributions due under the social insurance scheme, those due under the unemployment insurance scheme, compulsory statutory supplementary pensions and supplementary provident schemes.

The third type of expenditure is operating expenditure. They are fixed at a flat rate without any justification and represent expenses related to administrative activities, legal, commercial, transport, maintenance, security, etc. To calculate them, staff costs must be multiplied by 40% and depreciation by 75%. Except for young doctors, in which case their personnel costs must be multiplied by 200% (based on the unduplicated salary).

The fourth type of expenditure concerns outsourced R&D operations (subcontracting). External service providers may be in France, the European Union or the European Economic Area (Norway and Iceland and the EU) and must be approved by the MESRI. Since 1 January 2020, the tax authorities have tightened the framework for subcontracting expenses to be considered for the CIR in order to limit cascading subcontracting practices.

The fifth type of expenditure relates to the protection of intellectual property. Only patents, utility certificates, certificates of addition attached to a patent or utility certificate and plant variety certificates (VOCs) are eligible for the CIR with a ceiling of €60,000.

The sixth type of expenditure is standardisation expenditure. Although these are not R&D activities, participation in official meetings of the standardisation bodies that draw up French, European and world standards is eligible for the CIR. The amount to be taken into account is the sum of the salaries and social security charges corresponding to the period of employee participation as well as the other expenses related to this participation, capped at a flat rate of 30% of salaries.

The seventh type of expenditure concerns technology watch. This is the systematic gathering of information about scientific and technical achievements relating to products, processes, methods, and information systems in order to identify development opportunities. The amount to be considered for these technological monitoring expenses is limited to €60,000. However, this expenditure must be linked to the performance of R&D operations.

Finally, public subsidies, whether they are reimbursable, awarded by local authorities, the State or the European Union, must be deducted from the calculation basis in proportion to the operations giving rise to the RTC. As well as expenditure on consultancy services for the preparation of the CIR file.

R&D experts, ask for your CIR (Research Tax Credit) approvals

The Research Tax Credit (Crédit Impôt Recherche CIR) is a tax system reserved for expenses related to research and technological development (R&D) activities of companies. These expenses may be incurred by the company or by subcontractors. On the condition that these subcontractors, organizations or experts, are previously approved by the Ministry of Research.

Therefore, as an individual expert carrying out research and technological development activities on behalf of companies, you can apply to the Ministry of Research for a Research Tax Credit approval.

Remplissez le formulaire sur Service-Public.fr pour demander l'agrément CIR

How does it work in practice? Simply go to the service-public.fr website to fill out the application for approval for the research tax credit for individual experts. The first part of the form allows you to identify yourself and give your postal address and telephone number.

Then, the second part focuses on the recent and significant research operation that you have performed and that would qualify you as a technological R&D expert. Thus, you must indicate the title of the research operation performed (preferably the activity that best illustrates your R&D expertise and the most recent one).

We now move on to the most delicate step, namely the details of the search operation. Indeed, the form invites you to import a file in rtf, doc, docx, pdf or zip format up to 6Mb. The content of this document is similar to that of the supporting file written by companies as part of their Research Tax Credit procedures.

Therefore, you should briefly introduce yourself and describe your activity. You can also specify any R&D indicators such as the filing of a patent for which you are co-inventor, your publications and scientific reports, the theses you have supervised, your collaborations with public or private laboratories as well as your R&D expertise services of less than 5 years.

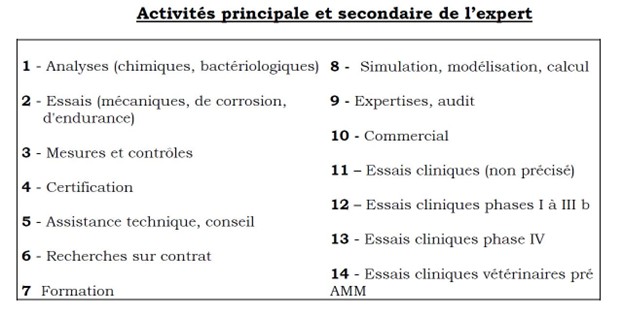

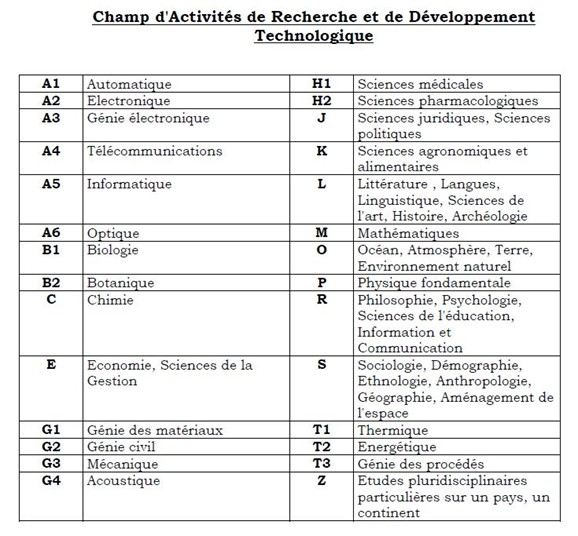

Finally, you must present an R&D project completed within the last year or in progress. To do so, start with the scientific and economic context of the R&D project, then indicate the name of the R&D project and the alpha-numeric code according to the tables below:

Describe in detail the state of the art and the R&D research of your project

You will also include a reminder of the state of the art at the initial stage of the project and the bibliographic references. Then, you will describe the objectives and the performances you wish to achieve. Including the constraints encountered, the difficulties to overcome and the problems to solve.

Now, you will have to write the details of your R&D work in three or four pages, avoiding talking about work that does not fall under the activity eligible for the Research Tax Credit (such as bibliographic research, writing specifications, studies and engineering).

And you will describe the scientific and technical progress achieved thanks to your R&D work, the place where the work was carried out, the materials and means implemented and the overall cost of the research project and the amount of your participation.

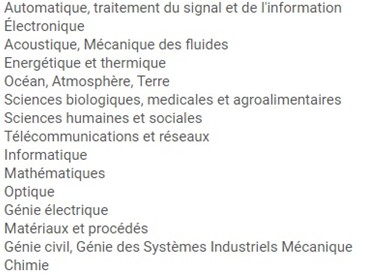

With this, you must also choose among the following areas the one that best represents your R&D activity:

And indicate the date of the beginning of the research operation and the date of the end. Finally, you must attach your CV in rtf, doc, docx, pdf or zip format (in French or English) and your highest diploma.